Connecting Apps, People and Banks

With support from over 280 Canadian Financial Institutions, Inverite is the clear market leader in Instant Bank Verification. Quickly, easily and securely connect your users’ financial data to your business through widely adopted OAuth regardless of whether you are a personal finance app, online lender, or money service business.

Features

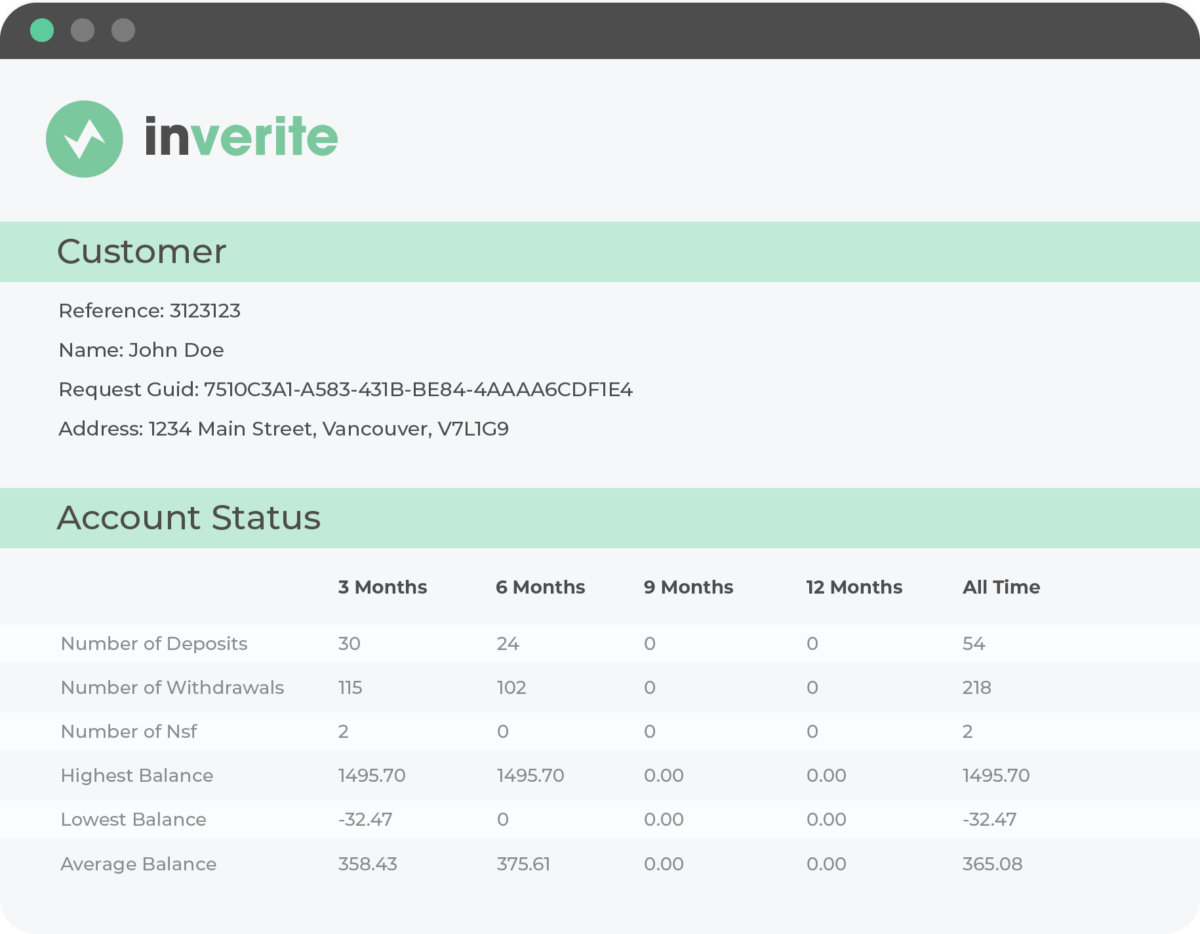

- Access full account, transit, and institution numbers from over 280 Canadian financial institutions.

- Access transaction history from over 280 Canadian banks and credit unions.

- Flexible reporting length for up to 365 days.

- Categorize and summarize transactions.

- Access account owner’s name, address, and contact information.

- Choose from four distinct APIs to meet your integration requirements.

Benefits

- Get the most comprehensive view of users’ financial data all in one place.

- Gain valuable insights into user spending habits and improve financial decision-making.

- Eliminates potential transaction fraud in lending.

- Ensures highly accurate verification to reduce the risk of rejected transactions due to incorrect information.

Use Cases

Loan Adjudication

Streamline your lending decisions with Inverite’s fast and accurate loan adjudication process.

Authenticate Payments

Secure your transactions with Inverite’s payment authentication system, ensuring peace of mind with every transaction.

Verify Income & Transactions

Confirm financial credibility with Inverite’s solution to verify income and scrutinize transactions.

Risk Score

For ultimate performance, we built a custom Risk Score using banking data, customer profiles, and repayment history to help you make ore informed decisions. Combine the power of Instant Bank Verification and Risk Score for a revolutionary approach to risk modelling.

The Inverite Insights Difference

DATA POINTS IN CANADA

Unique customers

%