Blog

The Benefits of Open Banking for Canadian Lenders

The Benefits of Open Banking for Canadian Lenders Canadian lenders experience the benefits of open banking through real-time data access, improved risk management, and efficient fintech integration. This results in faster decision-making and cost savings. Learn how...

Effective Fraud Mitigation Beyond Fintrac for Canadian Lenders

Effective Fraud Mitigation Beyond Fintrac for Canadian Lenders Relying solely on FINTRAC Know-Your-Customer (KYC) regulations isn’t enough for Canadian lenders to counter modern fraud threats. This article explores advanced technologies like AI and internal controls...

Unlocking Opportunities with AI and ML in Canadian Banking and Finance

Unlocking Opportunities with AI and ML in Canadian Banking and Finance Unlocking opportunities with AI & ML in Canadian banking and finance means transforming how banks operate. From fraud detection to customer service to credit scoring, these technologies provide...

What Does Alternative Credit Data Mean for Canadian Lenders

What Does Alternative Credit Data Mean for Canadian Lenders? Alternative credit data is transforming how Canadian lenders evaluate potential borrowers. This data goes beyond traditional credit scores to include utility and rental payments, providing a more...

The Potential of Consumer Directed Finance for Empowered Financial Choices

In our ongoing series on new and evolving financial technology we answer the question: What is Consumer Directed Finance, and how does it empower you to make better financial decisions? At its core, it’s about taking ownership of your financial data to personalize and...

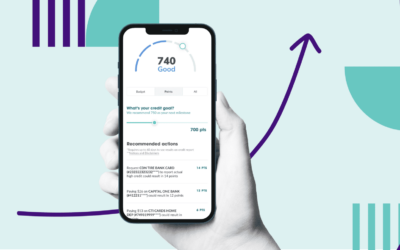

What Is a Credit Score? How to Improve Your Financial Footprint

It wasn't always this way, but knowing your credit score is one of the most important pieces of information you need for survival in the 21st century. So if you are wondering what a credit score is and why it’s crucial, buckle up! A credit score is a numerical...

Understanding What is Open Banking and Its Impact on Your Finances

In this article, which is a part of our ongoing Fintech Series, we answer the question: What is open banking? Open banking is a financial practice that allows third-party providers to access your banking data with your consent, fostering a tailored banking experience....

Exploring the Shades of Financial Inclusion: What Is Underbanked?

Welcome to the new millennium, complete with its myriad of acronyms and terminology. We're constantly climbing a steep learning curve, yet, for matters of inclusion and exclusion, it's essential to grasp the concept of the "underbanked" to effectively tackle financial...

Industry News – New York Times – The High Cost of Bad Credit by Mya Frazier

The High Cost of Bad Credit Original Article - https://www.nytimes.com/2023/06/07/magazine/bad-credit-repair.html Desperate to improve their ratings, Americans now spend billions on “credit repair” — but the industry often can’t deliver on its promises. By Mya Frazier...

2021 Projections: How the pandemic has affected personal finances in North America

Personal finance post-pandemic: 2021 overview and financial projections The number one most overused word of 2020 and 2021 has to have been “unprecedented.” It became the calling card for every description of what would become a definitive beginning to a decade - a...

How Marble Financial is helping Clients fix their credit

Fixing broken credit - Marble’s exclusive rights to point deduction technology in Canada 61% of Canadians have a credit score of 750 or above, scores which are considered between “good” (720-779) and “excellent” (780-850). Although credit scores are measured on a...

How Artificial Intelligence is Altering Personal Finance in 2021

AI-Powered Personal Finance Advice: A Goal-Oriented Approach to improving Financial Wellness As a concept, Artificial Intelligence (AI) is far from new. Even the ancient Greeks had stories about Talos, the giant bronze statue which defended the island of Crete by...

Marble Financial: Solving The 2021 Canadian Personal Finance Crisis

Let’s start with the bad news: a lot of Canadians don’t feel that they have control of their money. Statistics show that: 74% of Canadians are concerned about paying bills(1) 53% of Canadians are living paycheque to paycheque(2) 33% of Canadians have financially...