Advanced Alternative Database

With Micro Check, all alternative loans requested by individuals will be available in one place and updated regularly. This centralized database is shared amongst lenders to make sure there isn’t any delay or error during processing time.

Eliminate More Risk

The only Canadian Database comprised of Non-Registered loans that allow Canadian lenders, affiliated or not, to:

- Access and share information on people’s creditworthiness.

- Judge and avoid the risks associated with loans.

- Help lenders make informed decisions.

- Exclusive Canadian Database of Non-Registered loans, facilitating creditworthiness information sharing among lenders.

Benefits

-

Ensures accurate and data-driven decisions for your business by enabling statistical predictions based on millions of transactions and profile data.

-

Simplify your underwriting to make faster and more informed lending decisions.

-

Mitigate fraud risk to prevent future losses and adverse events.

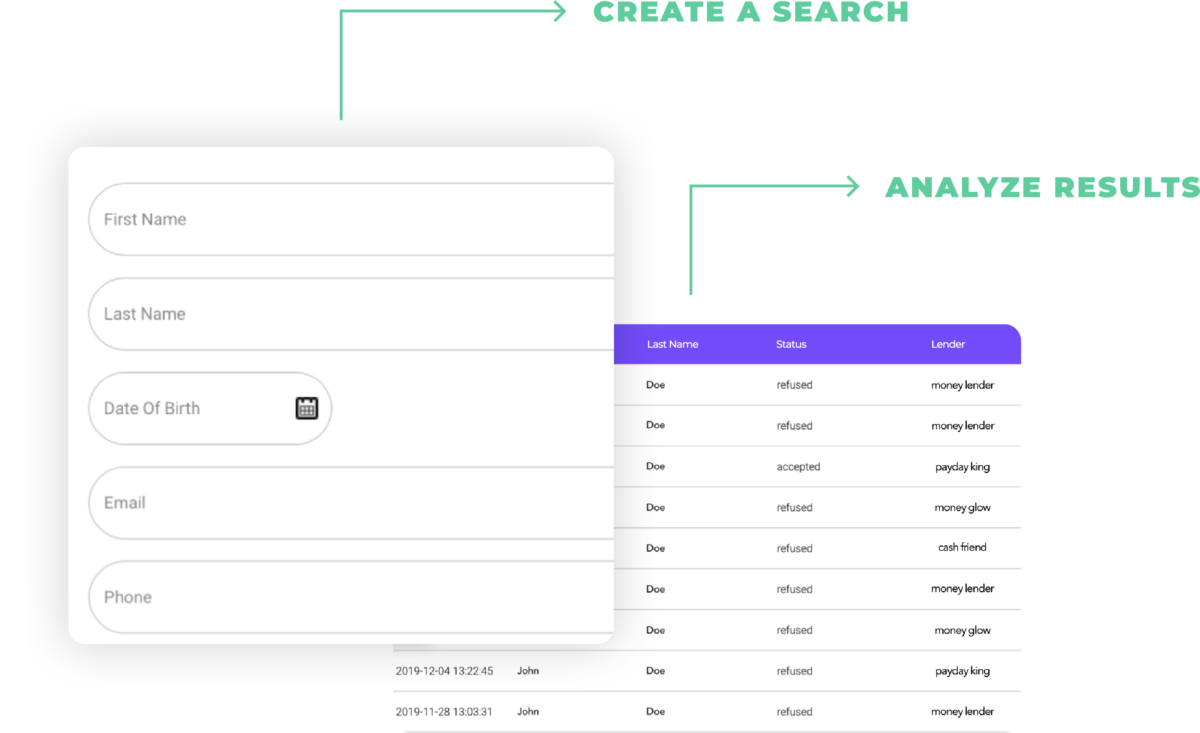

Before the Loan

Helping lenders make a better choice.

- Access customer personal information.

- Access the total number of loans contracted by a client whether or not they have been granted, as well as the amounts.

- Discover the status of a client, and their history, as identified by other companies.

- Ensure the consistency of the information provided thanks to real-time updates.

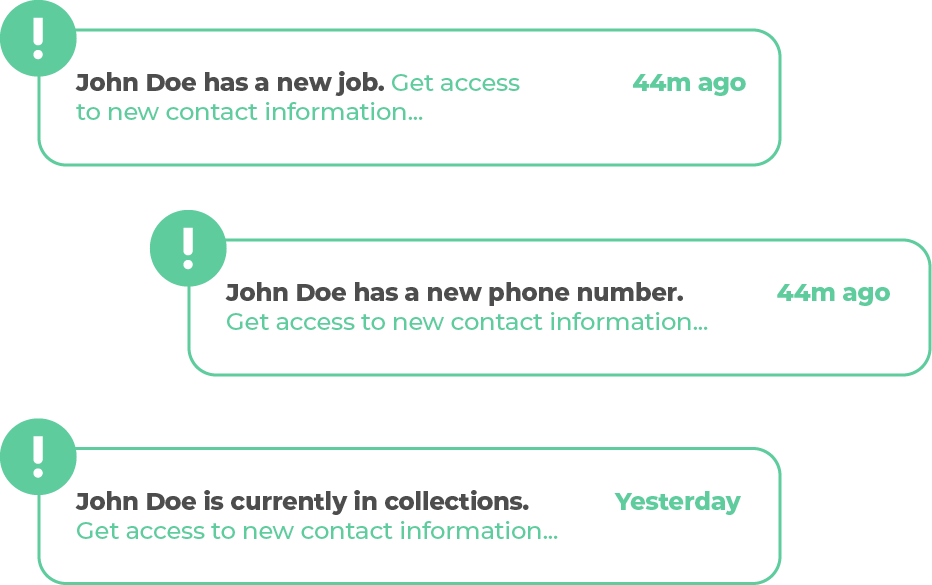

After the Loan

Access More Customer Data When Needed.

- Discover new personal customer information.

- New address, job, or phone numbers.

- Possibility of tracking.

How to Connect

Combine with Other Solutions

Bank Verification

As the top open-banking provider, we offer rapid access to a year’s worth of data from 280+ Canadian financial institutions through our APIs.

LEARN MORE

ID Verification

We are the only Canadian provider of 100% browser-based Identity and Age Verification that does not rely on credit bureau checks.

LEARN MORE

Risk Score

Our Risk Score uses neural networks and machine learning algorithms to revolutionize risk analysis.

The Inverite Insights Difference

DATA POINTS IN CANADA

Unique customers

%