Robust, reliable customer data, ready for real-time decisions.

Inverite delivers decision-ready customer data by combining bank verification, identity, cash-flow intelligence, and risk signals into one trusted layer.

Trusted by lenders, fintechs, and B2B platforms that rely on high-integrity customer data.

See what’s possible with Inverite

See the full customer

Not just a credit score — real income, real spending, real behavior.

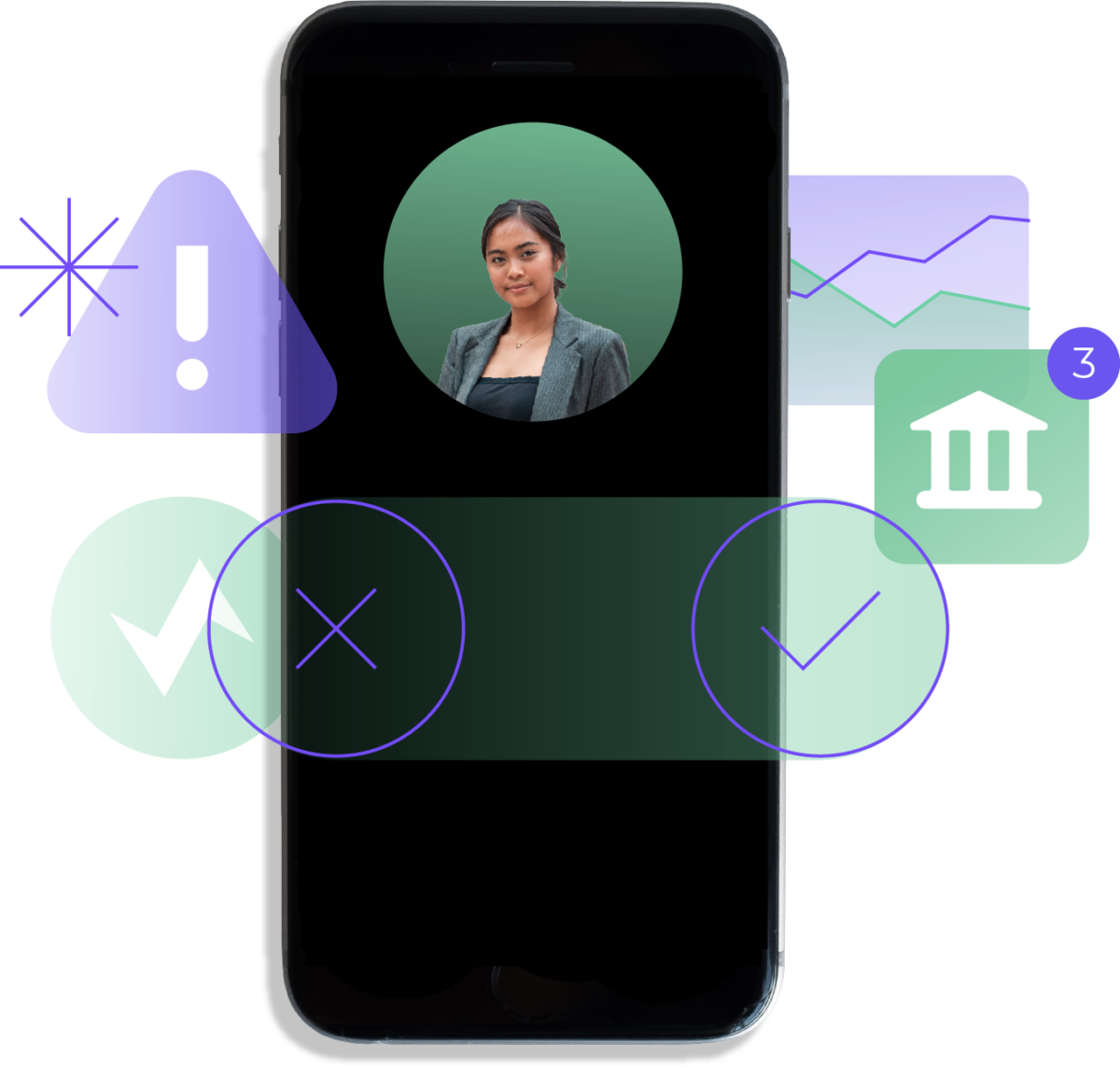

Protect real people

Stop identity theft, account abuse, and loan stacking before they cause harm.

Serve more qualified customers

Approve more legitimate borrowers, including gig, freelance, and non-traditional earners — without increasing risk.

Why choose Inverite

Lender-first design

Not just a credit score — real income, real spending, real behavior.

Decision-ready data

Categorized, enriched, and scored — not just raw transactions.

One trusted layer

Identity, bank, behavior, and risk in one profile.

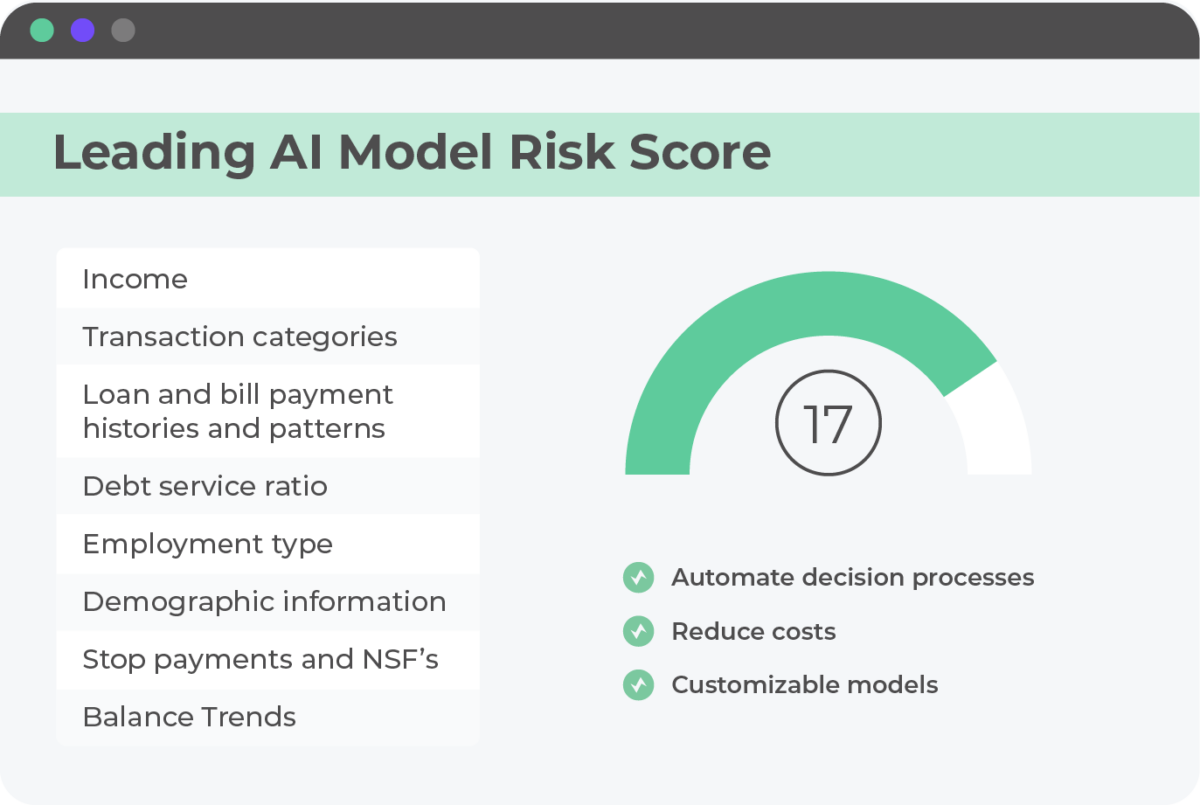

From raw transactions to clear signals

Our cash-flow-based risk scores give your decision systems a trustworthy signal for approve / decline, built for how people actually earn and spend today.

Everything you need to trust a customer,

in one data layer

ID Verify & Age Verify

Verify the person

Face + government ID + liveness + fraud protection

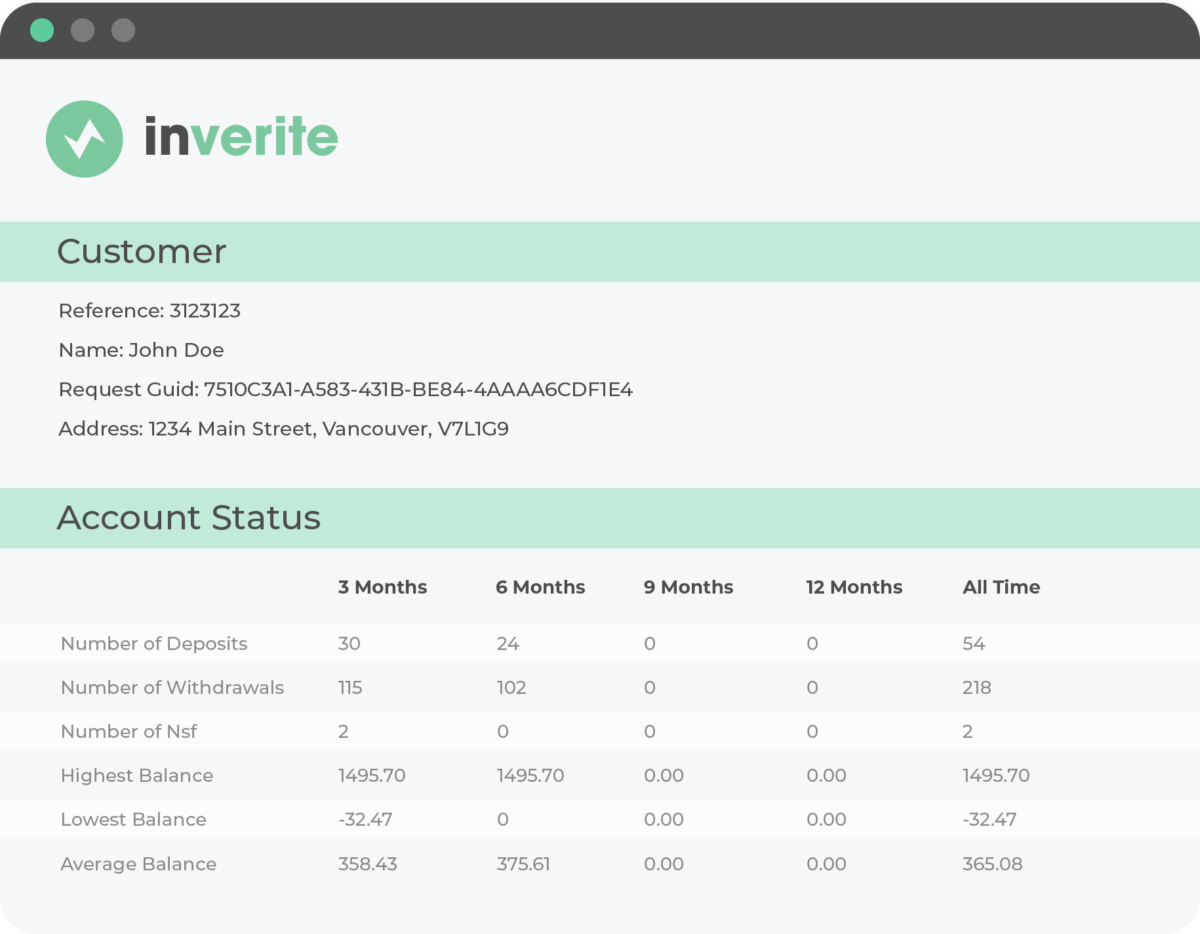

Bank Verify & Income

Verify the money

Live bank data, categorized income & spending, fraud signals, NSFs, and account ownership

Risk Score & RMaaS

Turn activity into portfolio-specific signals

Out-of-box or custom cash-flow risk scores built on your own loan peformance data.

Micro Check

Verify the behavior

Detect loan stacking, past attempts, off-bureau risk, and complete skiptracing

Impactful metrics. Not vanity metrics.

Fewer false declines

Approve more real people with real income.

Safer experiences

Approve more real people with real income.

Faster access to funds

Approve more real people with real income.

Confident approvals

Approve more real people with real income.

Data you can trust. Infrastructure you can rely on.

- SOC 2 Type II compliant

- Government-grade identity verification

- Bank-verified account ownership

- DIACC, FDX, and FDATA membership & alignment

- Privacy and security built in from day one

This is what makes Inverite’s data robust, reliable, and decision-ready.

Proud members of