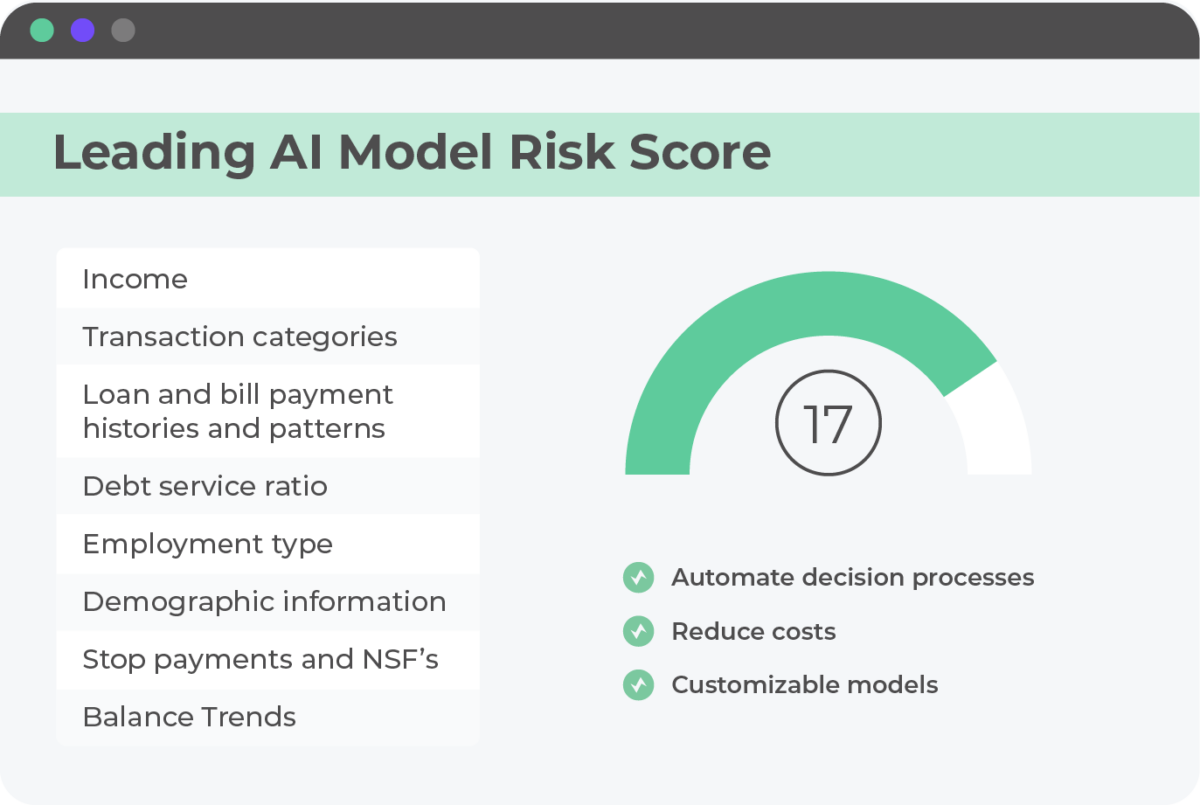

The Future of Risk Analysis Is Here

We offer different risk models to match the different conditions of your industry. For the ultimate performance, we can build a custom risk model that, in addition to banking data, also uses customer profile information and past customer repayment history to further enhance algorithms.

Features

Machine learning-powered algorithms leverage insights from over one million banking reports.

At-a-glance applicant summary information including income type, income amount, income frequency, and upcoming payroll date predictions.

Trained custom models tailored specifically to your business.

Benefits

Streamlined compliance: ensure that your business stays on top of industry regulations, allowing you to focus on growing your business.

Simplified processes: simplify your underwriting process, giving you more time to manage other areas of your business.

Increased security: Protect your business and customers from fraud and other security risks.

Combine with Other Solutions

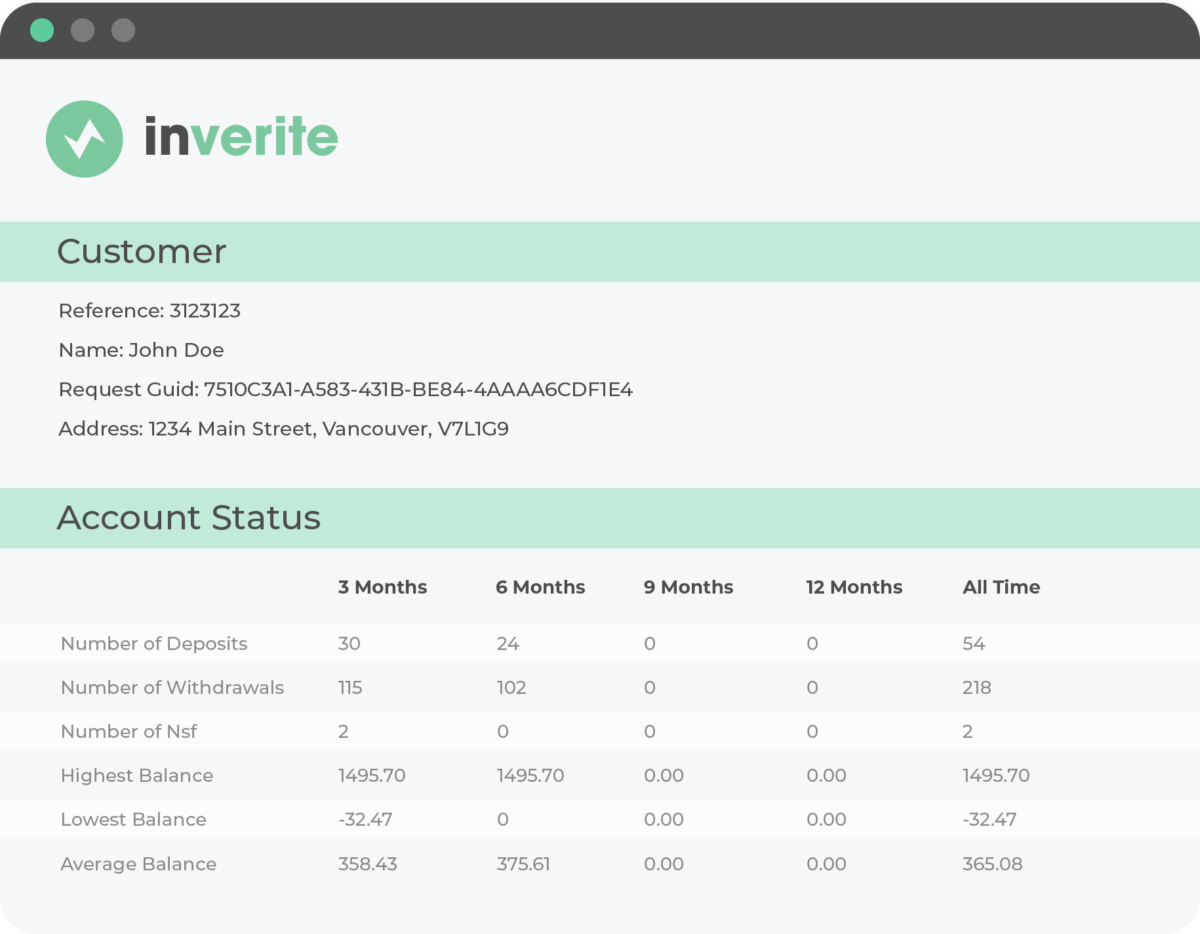

Bank Verification

As the top open-banking provider, we offer rapid access to a year’s worth of data from 280+ Canadian financial institutions through our APIs.

LEARN MORE

ID Verification

We are the only Canadian provider of 100% browser-based Identity and Age Verification that does not rely on credit bureau checks.

LEARN MORE

Micro Check

With Micro Check, all alternative loans requested by individuals will be available in one place and updated regularly.