BANK VERIFY

INSTANT BANK VERIFICATION

Strong for fraud prevention. Simple for customers.

Verify identity and account ownership and access actual bank data in real-time so you can onboard, fund, and underwrite with confidence. Bank Verify provides the real data that you need to power lower-risk decisions and reduce fraud and friction.

Confirmed accounts, categorized data, and faster decisions

Verify the account holder and retrieve trusted banking data instantly. Then, leave the categorization up to us so you can focus on making decisions.

Widest coverage across Canadian institutions

Connect users to the banks they already use with support for over 280 institutions, without forcing manual workarounds.

Name Match for stronger KYC confidence

Support faster decisions with traceable rationale, useful for internal review and regulator-ready documentation.

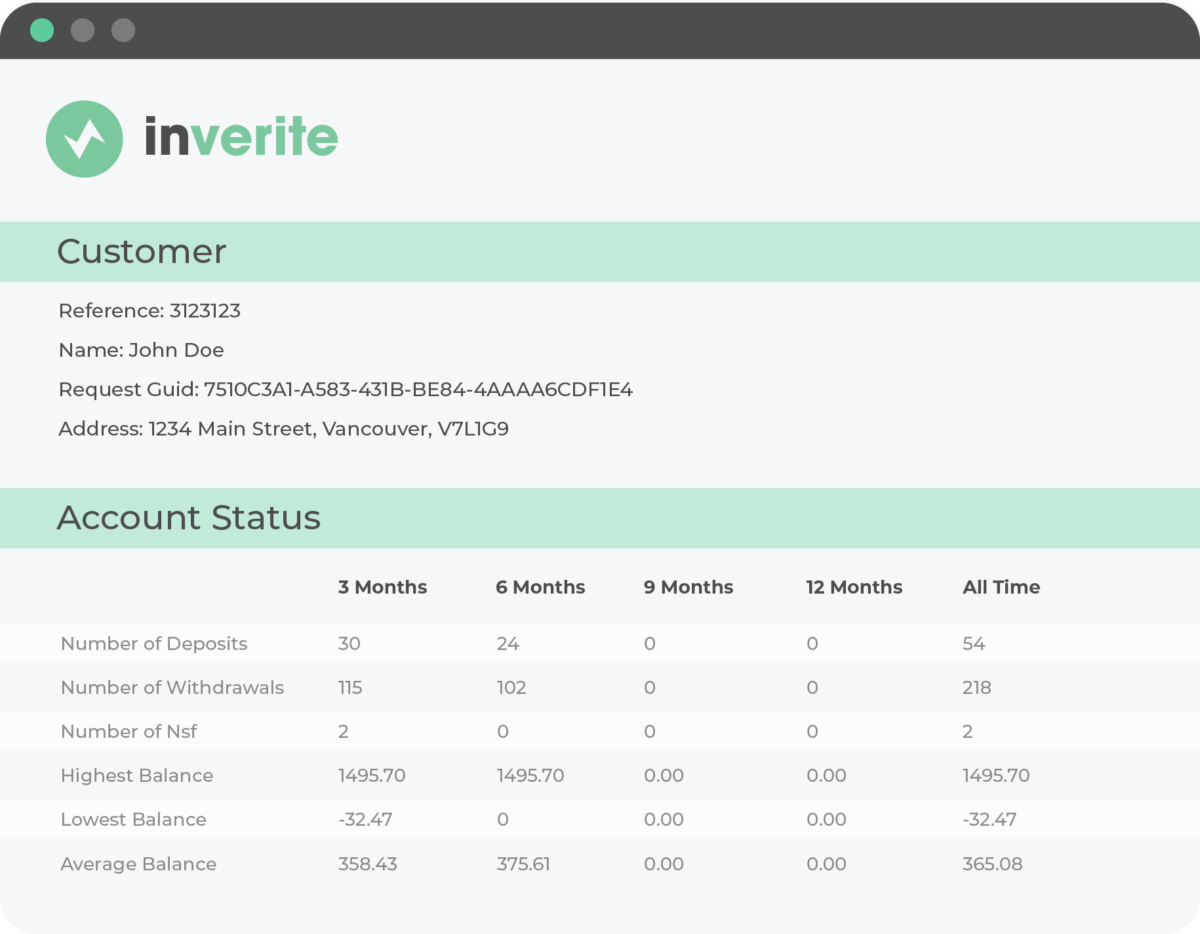

Make decisions based on real bank data

Connect to a customer’s bank to verify account ownership and retrieve banking data in real time so that you can make decisions based on real data. This includes transaction data and account, transit, and institution numbers from over 280 Canadian financial institutions.

Flexible reporting

Flexible reporting legnth for up to 365 days to meet your organization’s needs and standards.

Industry-leading automated categorization and automation

Inverite offers best-in-class categorization so your team can spend less time sorting data and manually evaluating applicants.

Reduce fraud

Reduce fraud and identify synthetic accounts by confirming the customer is the legitimate account holder and has real incomebefore funding or withdrawals.

End-to-end support

Supports onboarding, account funding, and payment setup by verifying bank details up front.

Dual-method support

Add Name Match to compare customer identity to bank-held identity with a confidence score. Accounts for nicknames, initials, and common typos, automatically.

Use Cases

Loan Decisioning

Automate your knockout rules and focus underwriting time on the files that actually qualify.

Cash Flow Underwriting

Verify income and affordability with real-time bank data, so you can approve the right borrowers faster and reduce risk.

Loan Servicing & Collections

Empower your agents to more easily locate borrowers, assess affordability, and improve recovery outcomes.

Related features

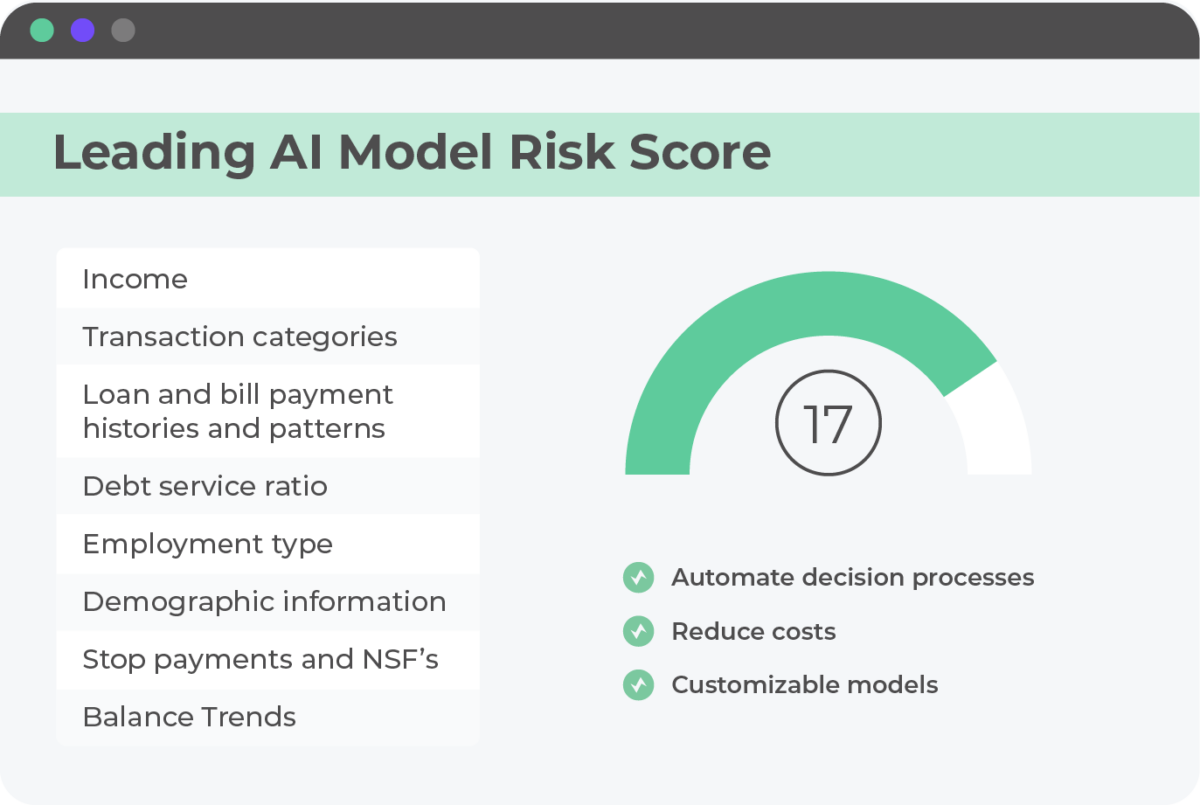

Risk Score

Turn verification outputs into an easier decision signal for automated workflows.

Micro Check

Access alternative loans reported by 100+ reporting lenders so you can get the full picture of your applicants’ borrowing history.

ID Verification

Add document + liveness identity verification at onboarding to strengthen trust from the first step.

Integrate with ease

Flexible integration: use our iFrame version for quick setup or integrate via API for a seamless verification experience in your existing flow.

Drop Bank Verify into key moments (new customer onboarding, funding, payment setup) with an API-led implementation designed to be lightweight for product teams.

Add Name Match with the same integration to automatically compare user-provided identity to bank records and return a confidence score.

“Inverite’s IBV, IDV, and Risk Score products have become essential tools for my clients, consistently outperforming competitors with significantly higher instant bank verification success rates along with the coverage of financial institutions. These solutions have accelerated decisioning, improved risk accuracy, and delivered measurable ROI across lending operations.

Just as important, Inverite’s team has been transparent, responsive, and highly adaptable to our clients’ evolving needs—making them a standout partner in the fintech space.”

Experience fast and reliable verification.

Widest coverage of financial institutions in Canada – trusted by millions.